The U.K Governments decision to ban the sale of new petrol & diesel cars by 2030 presents some real challenges for the UK Automotive industry. A development lifecycle of 5-7 years is not unusual for a brand new model & when we are looking at a whole different powertrain & chassis with the consequent implications for production assembly then we are talking major developments.

The U.K Governments decision to ban the sale of new petrol & diesel cars by 2030 presents some real challenges for the UK Automotive industry. A development lifecycle of 5-7 years is not unusual for a brand new model & when we are looking at a whole different powertrain & chassis with the consequent implications for production assembly then we are talking major developments.

JLR spent over $1 Billion developing its 2014 Engine Plant for Diesel & Petrol Engines, this gives some indication of the huge resource requirements for Battery powered vehicles.

There is a lot of debate as to whether Electric Vehicles actually produce less CO2 than their ICE (Internal Combustion Engine) counterparts but this report from ICCT organisation clearly debunks this.

There is some parallel with the elimination of leaded petrol, responsible for the death of over 5000 adults per year & countless examples of brain damage to children; it took over 12 years from unleaded petrol being available to a European Directive in 2000 before it was eventually banned.

Interestingly the Government announcement makes no mention of exporting ICE vehicles; only sales in the U.K. As we currently export 80% of all UK manufactured cars (admittedly 55% to the Eu) there is a little bit of wriggle room for Manufacturers to continue making ICE cars in lower volumes beyond 2030. There are many part of the World where Electric Vehicles will not prevail for many years to come but in urban conurbations in the ‘developed’ world their ascendancy is without doubt.

This will result in huge engineering & change management opportunities in the ever evolving automotive sector.

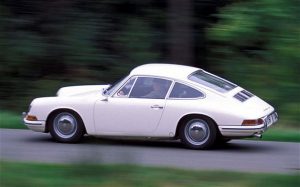

There will be much debate over the coming decade about the pro’s & cons of electric cars but there is no doubt about it, after a century of production the Internal Combustion Engine is heading for the breakers yard.

chris@amberhill.biz

Wow!! – 2020 – you couldn’t make it up; so where are we headed in 2021?

Wow!! – 2020 – you couldn’t make it up; so where are we headed in 2021? Nissan recently returned to work at it’s Sunderland Plant following an announcement about a post Covid worldwide restructuring which will see the closure of its Barcelona Plant & commitment to Sunderland as a manufacturing centre for Quashqai & Juke SUV’s & could also produce their Renault counterparts the Kadjar & Capture.

Nissan recently returned to work at it’s Sunderland Plant following an announcement about a post Covid worldwide restructuring which will see the closure of its Barcelona Plant & commitment to Sunderland as a manufacturing centre for Quashqai & Juke SUV’s & could also produce their Renault counterparts the Kadjar & Capture. — Geely group has invested in Lotus heavily & the company has a tight well targeted product range including the fantastic new all electric hypercar the Evija. The company has also benefited from picking up a number of talented & experienced engineers from JLR.

— Geely group has invested in Lotus heavily & the company has a tight well targeted product range including the fantastic new all electric hypercar the Evija. The company has also benefited from picking up a number of talented & experienced engineers from JLR. ment between the EEU & Japan to abolish tariffs between the two trading blocks negating the very existence of the Swindon plant. The Japanese car makers were attracted to the UK in the Thatcher era by a combination of Government grants & the ability to ship into Europe tariff free.

ment between the EEU & Japan to abolish tariffs between the two trading blocks negating the very existence of the Swindon plant. The Japanese car makers were attracted to the UK in the Thatcher era by a combination of Government grants & the ability to ship into Europe tariff free.

Jaguar Land Rover which has seen continuous expansion for the last decade has laid off 1000 contractors at its Solihull plant & has been cutting back on production volumes. Nissan in Sunderland has announced redundancies although these aren’t compulsory (yet!).

Jaguar Land Rover which has seen continuous expansion for the last decade has laid off 1000 contractors at its Solihull plant & has been cutting back on production volumes. Nissan in Sunderland has announced redundancies although these aren’t compulsory (yet!). Sir James Dyson has revealed what many automotive industry insiders already knew by rumour – his company is developing an Electric car ! The fact that Dyson have no automotive precedence or manufacturing facility should not be seen as a show stopper – there is plenty of subcontract capacity available (at a price) although his timescale of 2 years to volume manufacture is probably over ambitious.

Sir James Dyson has revealed what many automotive industry insiders already knew by rumour – his company is developing an Electric car ! The fact that Dyson have no automotive precedence or manufacturing facility should not be seen as a show stopper – there is plenty of subcontract capacity available (at a price) although his timescale of 2 years to volume manufacture is probably over ambitious. the industry did little to improve fuel efficiency until the oil crisis of the early 1970’s brought about the demise of gas guzzling V8’s & V12’s.

the industry did little to improve fuel efficiency until the oil crisis of the early 1970’s brought about the demise of gas guzzling V8’s & V12’s. commute we used to gather our thoughts and prepare for the day ahead is lost forever to the ever encroaching working day – whatever happened to ‘working from home’ ?

commute we used to gather our thoughts and prepare for the day ahead is lost forever to the ever encroaching working day – whatever happened to ‘working from home’ ?