1) What goes up MUST come down – I know it’s obvious but some people really believed it was possible for an economy to grow at 7% per year indefinitely – just ask the punters on the Shanghai Index.

2) Gordon Brown didn’t abolish boom & bust – but then we all learned that 7 years ago. Capitalism, for all its pros & cons, is inherently cyclical.

3) Every Market is interconnected – more so now than ever before, any crisis in China will be replicated to one extent or another around the globe.

4) No Government controls the market – whether its the State Capitalist Chinese or the Western Democracies – intervention is limited in its affect.

5) Transparency is a concern – Is the Chinese economy still growing at 6%, 5% or much less – no one knows & there is a distinct lack of trust in the data supplied by the Chinese government.

6) It will impact us all :- The Chinese economy is the second biggest market in the world & although exports vastly exceed imports the purchasing power of the Chinese middle classes will be severely curbed.

7) Social upheaval will follow – The political tensions in China will erupt (to one degree or another); The Chinese Government will struggle to keep a lid on the educated middle classes who have got used to continuous growth & increased wealth.

8) Capitalism is in crisis – as boom follows bust & vice versa Capital flows to the point of highest growth – leaving chaos in its wake.

9) What comes next ? – no one knows – but maybe we should be looking to develop a sustainable society based on full-filling human needs rather than continuously expanding Gross Domestic product ?

10) The sun still rises in the East, sets in the West & the world keeps on turning.

There has been some debate in the Media recently about buying British products as a way of reducing the impact of the recession & preserving British jobs; so is this a good idea ?

There has been some debate in the Media recently about buying British products as a way of reducing the impact of the recession & preserving British jobs; so is this a good idea ? 2012 has been a pretty miserable year with freakish weather on both sides of the Atlantic, in the U.K the highest rainfall since records began saw people washed out of house and home and businesses ruined. In the USA Hurricane Sandy battered the East Coast and several lives were lost, homes ruined & businesses destroyed.

2012 has been a pretty miserable year with freakish weather on both sides of the Atlantic, in the U.K the highest rainfall since records began saw people washed out of house and home and businesses ruined. In the USA Hurricane Sandy battered the East Coast and several lives were lost, homes ruined & businesses destroyed. The news today that Barclays CEO Bob Diamond has resigned has been greeted in many areas with unbridled euphoria. Those who blame “greedy bankers” for the current crisis are rubbing their hands in glee.

The news today that Barclays CEO Bob Diamond has resigned has been greeted in many areas with unbridled euphoria. Those who blame “greedy bankers” for the current crisis are rubbing their hands in glee.

A new sales record of over 314k cars and profits of 1.5 billion GBP illustrate the success of British car maker Jaguar Land Rover and it’s innovative new products including the Range Rover Evoque which is selling like “hot cakes” at the moment particularly in China. In fact Jaguar Land Rover is opening a new dealership in China every week. China sales now represent almost 20% of the companies sales.

A new sales record of over 314k cars and profits of 1.5 billion GBP illustrate the success of British car maker Jaguar Land Rover and it’s innovative new products including the Range Rover Evoque which is selling like “hot cakes” at the moment particularly in China. In fact Jaguar Land Rover is opening a new dealership in China every week. China sales now represent almost 20% of the companies sales. General Electric

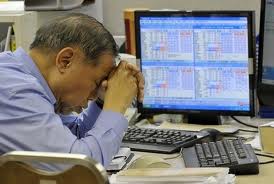

General Electric We have seen trillions wiped off stock markets worldwide, the FTSE 100 has lost over 10% of it’s value in the last week alone & our TV screens have been filled with hysterical traders and concerned politicians.

We have seen trillions wiped off stock markets worldwide, the FTSE 100 has lost over 10% of it’s value in the last week alone & our TV screens have been filled with hysterical traders and concerned politicians. How does your Organization treat the people it employs ?

How does your Organization treat the people it employs ?